By Guillaume Mascotto, vice president, head of ESG and investment stewardship at American Century Investments

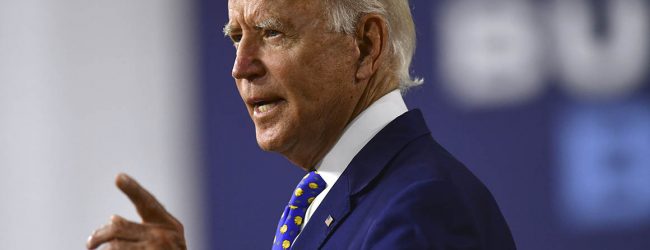

While the U.S. will likely remain structurally divided on constitutional issues, under president-elect Joe Biden, ESG observers may expect the U.S. to rejoin the Paris climate deal, restore methane/fracking regulation on domestic oil and gas drilling, and re-enact federal GHG emissions-reduction initiatives such as the Clean Power Plan. Biden’s stance on climate change is also likely to be echoed by a Democratic-controlled Congress, resulting in a strengthening of the federal government’s role in energy and environmental policy. While the appeal of investing in intermittent renewable energy assets will continue irrespective of regulatory developments as technological learning curves improve, an abrupt switch away from fossil fuels is likely to be limited as a result of continued low natural gas prices, infrastructural obstacles and possible push-back on behalf of a Republican-controlled Senate.

At the same time, Biden has voiced his support to promote a gradual energy transition, in which natural gas (and by extension the controversial practice of fracking) is likely to remain categorized as a “transitional fuel”. As such, we believe the focus on environmental protection and operational health and safety will continue to be material issues at the forefront of the fracking debate.

We also expect interest in ESG investing to continue gaining momentum beyond political and regulatory developments such as the Department of Labor’s proposed rule on limiting ESG investment options for pension plans. This corresponds with deep shifts in investor mindset and the growing linkage between ESG issues and their economic impacts. The COVID-19 pandemic and its material human, economic and financial costs will likely continue to support the notion that the environment, public health and the global economy intertwine. Tackling the pandemic will certainly remain an issue of priority order for Biden’s administration. This should also continue to position healthcare as a key investment theme in 2021. That said, we believe the top ESG issue in 2021 (and beyond) will be the implications of transitioning toward a circular economy.

The key challenge for the Biden administration will be to maximize the incentives to scale advanced and knowledge-intensive renewable energy/closed-loop solutions while balancing social and economic considerations. Ultimately, adapting our system to address this issue can be achieved only through a sustained effort on the part of business leaders, policymakers, and their constituents to redefine traditional measures of productivity, wealth and well-being.