By Patrick Wood Uribe, Chief Executive Officer, Util

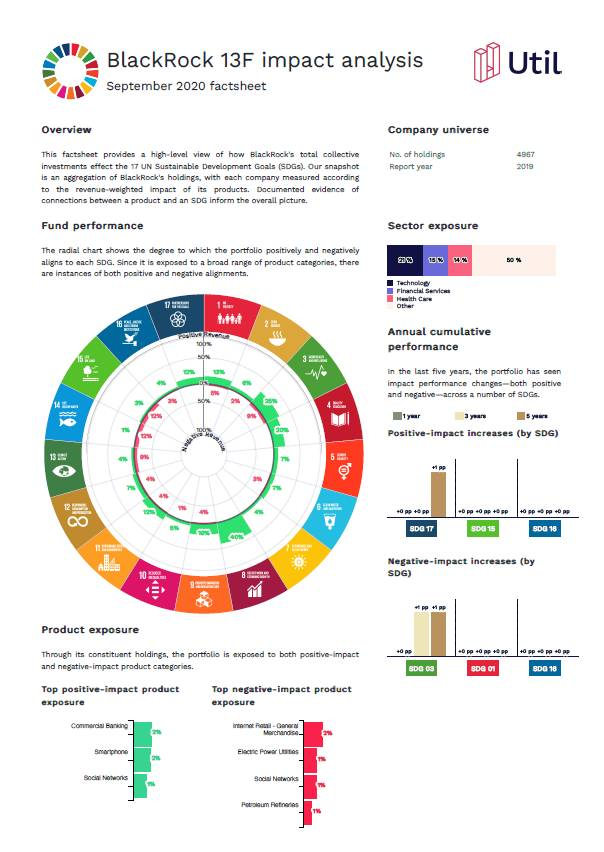

Util is a London-based financial technology company that uses machine learning to measure the impact of a company’s products or services. Using natural language processing (NLP), Util analyses text from articles, academic research and journals to generate an automated ESG score for each of the 17 United Nations SDGS for a company’s products and for the company as a whole.

According to chief executive officer, Patrick Wood Uribe, NLP’s accuracy in interpreting written text allows for the automated generation of ESG scores for thousands of companies. Util’s focus on products and services allows for more granular EGS scores compared with other ratings providers. “Our work is different from ESG data in that our data is designed specifically to allow our clients to understand how every listed company simultaneously affects a comprehensive range of global issues, not just ESG. What we have found is that our data also clearly shows the inherent trade-offs in our commercial world, and how important it is to move past simple ESG categories and provide investors with the information they need to decide for themselves”.

How do you solve a problem like ESG?

ESG is the talk of the town. It has been a record-breaking year for inflows to funds labelled as ‘ESG’, namely those focused on environmental, social, and governance issues. By some estimates, investment in these funds has increased 10x in the past year. Business is booming.

Yet there is also growing skepticism. Two separate research papers in the last year have highlighted the disagreement among ESG rating providers, one noting that the average correlation was 54%, the other that it was 46%. Differences in criteria (what counts as E or S or G), scope (how much of it counts), and weight (how important each factor is) mean that raters only agree about half the time. By contrast, the correlation among credit rating agencies is about 99%.

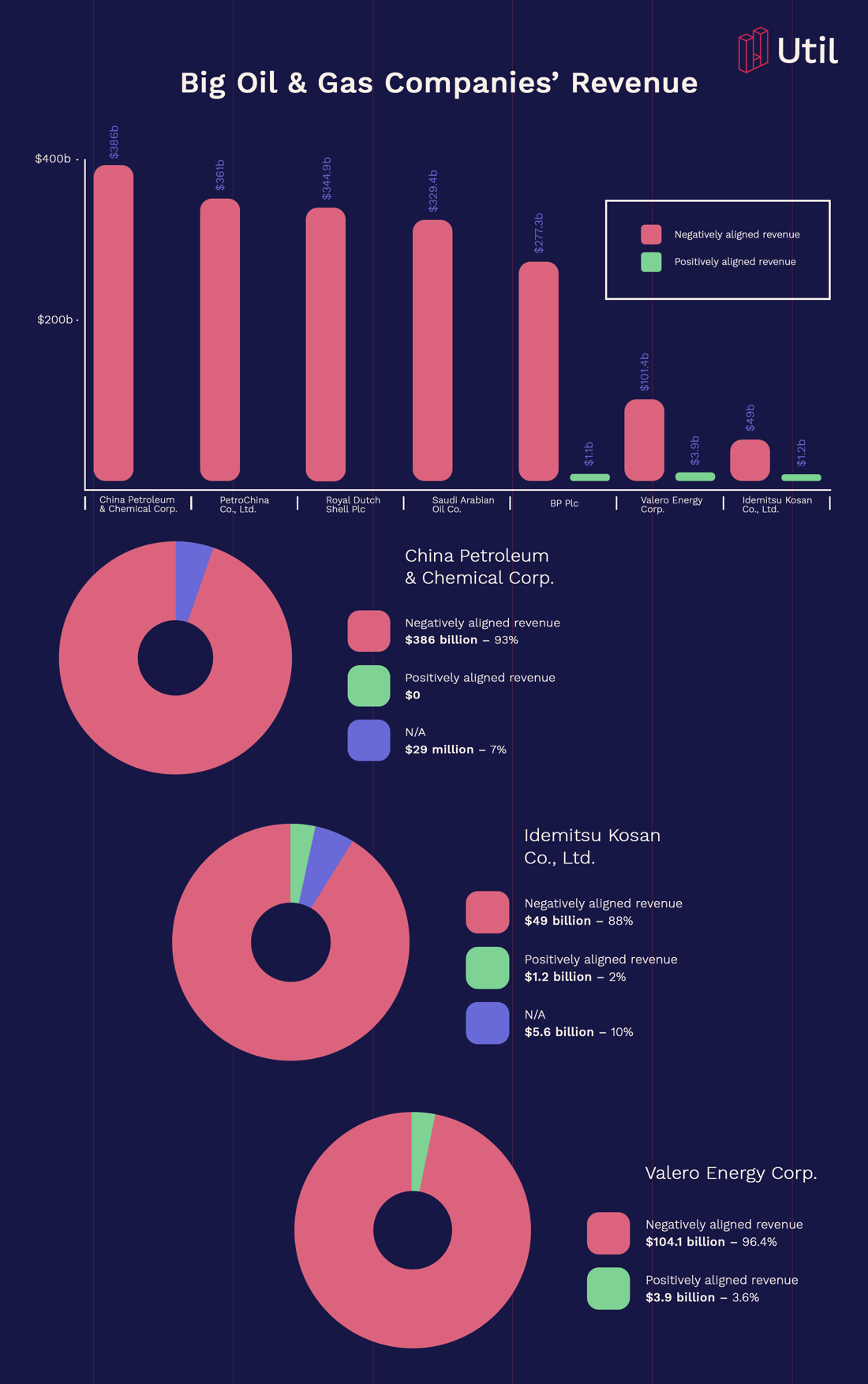

It’s not hard to see the problems that could arise from this combination of overwhelming demand for ESG assets and such inconsistent data being used to allocate them. Investors in some ESG ETFs might already be surprised at some of their constituents, either because the criteria are generous (in some cases, fossil fuel companies can be included as long as they are doing better than their peers according to the rater’s criteria), or because the logical boundaries are arbitrary. One ETF is designed to exclude companies that manufacture weapons, but includes Dick’s Sporting Goods, which sells them; the same ETF excludes companies with reserves of fossil fuels but includes airlines and car companies, whose services and products depend almost entirely on burning them.

At the same time, ESG factors have been associated with better company performance. On the surface, this makes sense: companies with good governance practices, or that treat their employees and customers well, or have a sense of environmental responsibility, are likely to be well run and well liked, and should perform better than peers without those features.

But there are two significant problems with the relationship between ESG and stock performance. Firstly, if ESG ratings only agree half the time, how do we even know the relationship exists? Secondly, in equity markets, many if not most of those factors should already be efficiently captured by stock prices: the next time an ESG-related scandal like Boohoo or Rio Tinto hits the news, try beating the market to the punch and you’ll see what I mean.

In the strongest version of the Efficient Market Hypothesis, all information is already incorporated into the price of a stock, and given the number of daily transactions in financial markets, the system works well. Prices reflect new information quickly, and extreme mis-pricing is comparatively rare. The one significant shortcoming is, broadly speaking, in sustainability: despite everything, we continue to do more harm than good in the world and remain on track eventually to deprive ourselves of an environment to care about.

Why should prices fail to capture information we know is so important? A few obvious reasons spring to mind. Cynics among us might say that the market is actually the more accurate reflection of our values, and that everything else is just lip service and empty rhetoric. Others might say that it’s the result of implicit investor self-preservation: it’s ultimately self-defeating to exit stocks with poor environmental records, for example, since the sell-off will ultimately drive their prices down sufficiently to turn them into an opportunity for others — at which point demand for the stock will return, the company will return to its previous market value, the harmful equilibrium restored, while others reap the profits.

This is, however, a fairly simple example. Most of the time, the situation is more complicated: how does an investor evaluate a company that makes jerseys out of 100% recycled material, but does so with questionable labour practices? Do both factors matter equally? If not, which matters more? How about a company that makes concrete, itself quite polluting but still a cheap way to build beneficial infrastructure like bridges and schools in emerging markets? Is ignorance somehow preferable to fine particulate pollution?

These questions bring me to another fundamental reason why markets seem not to incorporate sustainability information efficiently: in a word, complexity. The more complex the information — and its implications — the longer it will take to filter through to the price, if ever. In the case of sustainability information, as soon as questions like those I just raised are applied to more than a handful of cases, they quickly become too overwhelming to think about. And of course, if investors don’t think about these questions, they can’t realistically factor them into how they assess their investment choices. The market has to go without the information.

This is the gap that fuels the demand for ESG stamps of approval. But as we’ve already seen, that explosive demand has been met with inconsistent data, leading to calls on the one hand for greater transparency, or on the other hand for stronger regulation. I would say neither addresses the fundamental bottleneck we truly face: the biggest barrier to investing sustainably is how to process, understand, and act upon complex information about sustainability.